What Is The Common Way For A Central Bank To Reduce The Money Supply

Foreign Commutation Interventions by Central Banks: Main Talking Points

Key banks often deem it necessary to intervene in the foreign exchange market to protect the value of their national currency. Central banks can achieve this past ownership or selling foreign exchange reserves or simply by mentioning that a detail currency is under or over-valued, allowing participants of the forex market to do the remainder. This article looks at the unlike types of central banking concern interventions and important facts to proceed in mind earlier trading.

What is strange exchange intervention?

Strange substitution intervention is the process whereby a central bank buys or sells foreign currency in an attempt to stabilize the commutation rate, or to correct misalignments in the forex market. This is oftentimes accompanied past a subsequent aligning, past the central bank, to the money supply to showtime any undesirable knock-on effects in the local economy.

The mechanism mentioned above, is referred to as "sterilized intervention" and will be discussed later on, along with the other currency intervention methods.

How forex traders can merchandise a central banking concern intervention

Traders must keep in mind that when central banks arbitrate in the forex market place, moves can be extremely volatile. Therefore, it is essential to ready an appropriate risk to reward ratio and make use of prudent risk management.

Central banks arbitrate in the forex market when the current tendency is in the opposite management to where the key depository financial institution desires the substitution rate to be. Therefore, trading around central bank intervention is a lot like trading reversals.

Additionally, the forex market tends to anticipate key bank intervention meaning that it is not uncommon to see movements confronting the long-term tendency in the moments leading up to central bank intervention. Since there is no guarantee that traders can await for the new trend to emerge before placing a merchandise.

Why do central banks intervene in the foreign commutation marketplace?

Primal banks more often than not agree that intervention is necessary to stimulate the economy or maintain a desired strange exchange rate. Central banks volition often buy strange currency and sell local currency if the local currency appreciates to a level that renders domestic exports more expensive to foreign nations. Therefore, fundamental banks purposely alter the commutation rate to benefit the local economy.

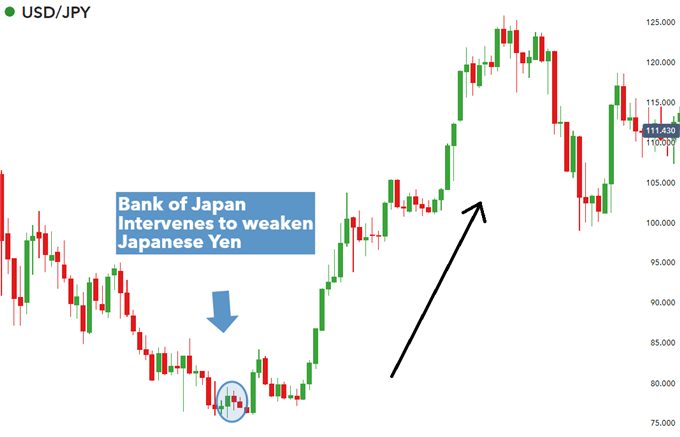

Beneath is an instance of successful primal bank intervention in response to Japanese Yen forcefulness against the US dollar. The Bank of Nihon was of the view that the exchange rate was unfavorable and swiftly intervened to depreciate the Yen thus, resulting in a move higher for the USD/JPY pair. The intervention took place in the timespan depicted past the blue circle and the effect was realised shortly thereafter.

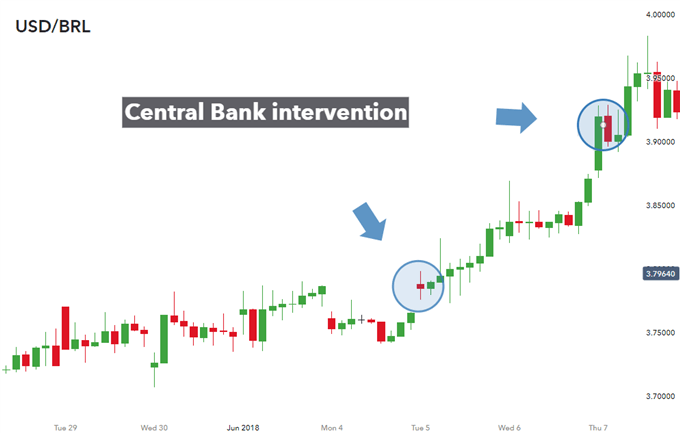

While nigh central depository financial institution intervention is successful, in that location are instances when this in not the case. The nautical chart below depicts a currency intervention example in the USD/BRL (Brazilian Real) currency pair. The chart highlights both instances where the cardinal bank intervened to finish the decline in the Brazilian Real. It is clear to see that both scenarios failed to immediately strengthen the Real against the U.s. dollar equally the dollar continued to rise higher and higher.

Read more than on the role of central banks in the forex market .

How does currency intervention work?

Central banks have a choice of dissimilar types of interventions to make use of. These can either be direct or indirect. Direct intervention, as the proper name suggests, has an immediate effect on the forex market place, while indirect intervention achieves the objectives of the cardinal bank via less invasive means. Below are examples of direct and indirect intervention:

| Types of intervention | Direct or Indirect |

|---|---|

| Jawboning | Indirect |

| Operational Intervention | Direct |

| Concerted Intervention | Direct and indirect |

| Sterilized Intervention | Direct |

- Operational Intervention: This is unremarkably what people mean when they refer to central bank intervention. It involves the central bank ownership and selling both foreign and local currency to drive the commutation rate to a targeted level. It is the pure size of these transactions that motion the market place.

- Jawboning: this is an example of indirect FX intervention whereby a central bank mentions that it may arbitrate in the marketplace if the local currency reaches a certain undesirable level. This method, as the name suggests, is more virtually talking than bodily intervention. With the primal bank fix to intervene, traders take it upon themselves to collectively bring the currency dorsum to more acceptable levels.

- Concerted Intervention: This is a combination of jawboning and operational intervention and is about effective when multiple central banks vocalization the same concerns over exchange rates. If a number of central banks increase their jawboning efforts, it is likely that ane of them actually conducts operational intervention to drive the exchange rate in the desired direction.

- Sterilized intervention: Sterilized intervention involves ii deportment from the central bank in order to influence the substitution rate and at the same fourth dimension, leave the monetary base unchanged. This involves two steps: The sale or purchase of foreign currency, and an open market place operation (selling or buying regime securities) of the aforementioned size as the commencement transaction.

Learn more near the role of central banks and forex trading

- DailyFX provides a dedicated cardinal bank calendar showing all the scheduled central depository financial institution charge per unit announcements for major primal banks.

- Bring together Senior Currency Analyst, Christopher Vecchio every bit he delves into the major primal bank trends and data releases via the Fundamental Banking company weekly webinar. We have a whole host of webinars covering a wide range of topics and markets. Book your place on the DailyFX webinar agenda.

- Keep upward to date with crucial central bank announcements or information releases happening this week via our economic calendar.

Read more about the major primal banks from around the earth:

- The European Central Bank

- The Bank of England

- The Swiss National Bank

- The Federal Reserve

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Source: https://www.dailyfx.com/education/forex-fundamental-analysis/central-bank-interventions.html

Posted by: hollowaycontaked.blogspot.com

0 Response to "What Is The Common Way For A Central Bank To Reduce The Money Supply"

Post a Comment