When Can You Take Money Out Of Whole Life Insurance

Paying life insurance monthly premiums may go a burden for policyholders who are facing coin constraints. This feeling worsens with the realization that life insurance benefits can be availed but after the death of the policyholder. However, i fact that many policyholders don't know is that they can cash out life insurance before death.

In tough fiscal times, people are sometimes left scrambling for cash to meet their expenses and lifestyle demands. In situations similar these, policyholders can consider cashing out their life insurance as a solution to a financial crisis. While cashing in your life insurance policy is a big conclusion that can have a significant influence on your financial life, at times information technology becomes a necessity.

To help you make up one's mind if yous should cash out a life insurance policy, we'll explain everything you demand to know virtually the process. Larn what cashing out a life insurance policy means, your options for doing so, along with the pros and cons of this option.

What Is Cashing Out A Life Insurance Policy?

Cashing out a life insurance policy refers to the process by which policyholders can admission accumulated cash value from their policies before their expiry. Normally life insurance works by policyholders paying premiums in exchange for coverage that provides a expiry do good upon their passing, and some policies also accept living benefits to assist fund retirement. However, policies that accrue cash value such as whole, variable, universal life insurance may allow the policyholder to admission some of that coin while they're still alive through loans, withdrawals, surrendering information technology, or selling the policy .

Cashing Out vs. Cashing In Life Insurance

When looking into cashing out life insurance you may as well hear about cashing in, in some cases these terms are used interchangeably. This is because there is no difference between cashing out and cashing in a life insurance policy. The terms refer to the aforementioned process that allows policyholders to admission greenbacks value from their life insurance policies while they're all the same live.

Tin can You lot Cash Out A Life Insurance Policy?

You tin can greenbacks out a life insurance policy while you're nonetheless alive as long equally you have a permanent policy that accumulates greenbacks value , or a convertible term policy that tin be turned into a policy that accumulates cash value.

In fact, you lot actually have several options for cashing out a life insurance policy such as withdrawing money from the greenbacks value, taking a loan against this value, surrendering the policy to the insurance company, or selling it through a life settlement . The choice that's best for you will largely depend on whether you desire to maintain coverage and how much money yous want to access.

Can You Cash Out A Term Life Insurance Policy?

Term life insurance tin can't exist cashed out because these policies do not accumulate cash value during the limited fourth dimension they provide coverage. However, some term policies accept an option that enables the policyholder to convert them into a form of permanent life insurance. In some cases these types of policies are called convertible term life insurance, in other cases this option is available in the form of an optional passenger for an added price.

If you have a term life insurance policy and are wondering if information technology can be cashed out, you should review your policy documents or talk to your insurer to encounter if it can be converted.

Ways to Cash out a Life Insurance Policy

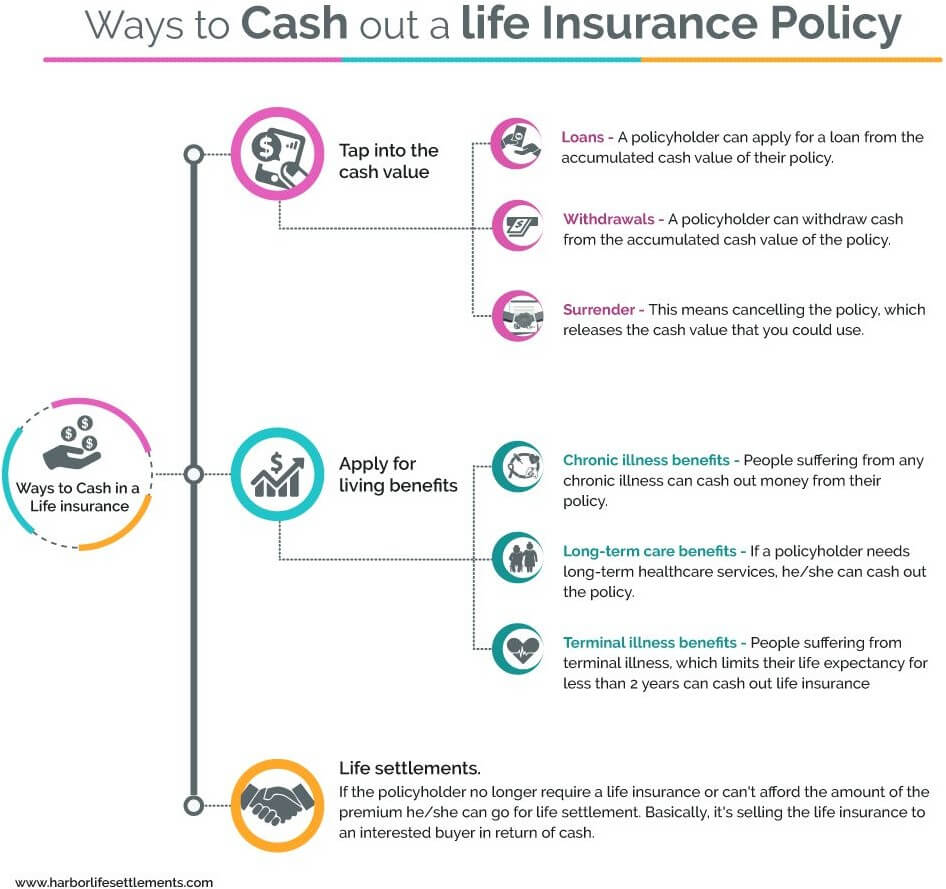

There are iii ways that y'all can cash out your life insurance policy while you're however alive:

- Tap into the greenbacks value through loans, withdrawals, or surrender

- Utilize for living benefits

- Life settlements

Not all options are available to everyone, as some have requirements related to age, health, and policy details.

If you take several means to cash in a life insurance policy, the all-time option depends on several factors like whether you desire to keep the policy or not and the amount of money that you lot want to admission. To aid you lot empathise your options, hither's more than information on the ways to cash out a life insurance policy while you lot're still live.

If y'all have permanent life insurance and want to tap into the policy's cash value, yous can exercise information technology in 3 ways:

one. Loans

Most life insurance companies allow policyholders to take a loan from the accumulated cash value of their policy. These loans don't have whatever repayment schedule like other loans. However, these loans will accrue interest charges that directly affect your expiry benefit, equally any money that hasn't been paid back when the policyholder dies will exist taken from the death benefit amount. This means you become less death benefit than y'all're supposed to.

Alternatively, yous could seek programs from other companies like our Whole Life Loan Program that may allow you to go 95% of your policy's cash surrender value.

2. Withdrawals

Withdrawals allow you to take coin from the cash value of your policy without worrying about interest charges. This is likely the easiest and fastest style to cash in a life insurance policy. Nonetheless, you demand to remember that withdrawals might lead to a change in your policy premiums and tin can affect your life insurance benefits. By taking money out, you're reducing the long-term growth potential and may leave a smaller death benefit to beneficiaries.

three. Surrender

Surrendering a policy is synonymous with canceling it. Once you cancel your policy, it releases all the cash value to the policyholder minus fees from the procedure. However, before surrendering, you need to exist sure that you don't need the coverage of the policy anymore. Furthermore, some policies will charge a penalty if you lot greenbacks out too early and you may also owe income tax if your payout exceeds the premiums you paid over the policy'south life.

Getting cash out of your life insurance by tapping into its cash value is the easiest fashion to cash in the life insurance policy. However, information technology doesn't piece of work for term life insurance policies since this type of life insurance doesn't have whatsoever cash value; a term policy would have to be converted into a permanent policy in order to be cashed out.

Getting Cash Out Of Your Life Insurance Through Living Benefits

Living benefits are another style to become the cash out of your life insurance policy, while you're still live. Life insurance with living benefits allows you to cash in a portion of your insurance in advance, which is up to l% in almost cases. However, to admission these benefits, there are sure criteria. You lot can only access these benefits if you meet the circumstances listed below:

i. Chronic disease benefits

Chronic illnesses, every bit you might know, stay with you for a long fourth dimension. Most people suffering from chronic illnesses demand assistance for at least two out of all activities that are required daily (known as ADLs) such equally bathing, eating, dressing, or sitting and standing. If y'all're suffering from whatever chronic affliction that has drained you financially, you lot can greenbacks out money from your life insurance as a office of your living benefits.

2. Long-term care benefits

Healthcare today is a very costly affair and people receiving long-term care demand to pay a considerable amount of money to receive necessary services. Some life insurance policies offer optional long-term care riders that yous tin can cash in to pay for assisted living costs.

3. Final illness benefit

Those who are certified as terminally ill by physicians with a life expectancy of fewer than 12 months can employ for living benefits and are eligible to greenbacks in their life insurance.

While all these benefits may come up standard in nigh life insurance policies, make sure that you are buying life insurance with living benefits. Some policies might contain various terms and conditions that might restrict yous from accessing them. You may also be able to sell your policy through a viatical settlement .

Cash Out Life Insurance Through A Life Settlement

The final way a policyholder can cash out their life insurance is past selling their policy through a life settlement. A life settlement is the process of selling your existing life insurance policy to a 3rd-party investor in return for greenbacks.

If yous don't demand the death benefits linked to your insurance, selling the policy is the best way to cash out because you'll get far more than money than you would by surrendering or letting it lapse. In fact, with a life settlement yous may exist able to get up to 60% of the death benefit amount in a lump cash sum that can exist used to fund retirement, get on holiday, or spend withal you want.

Though the amount yous receive through a life settlement is less than the actual death benefit, it provides more than greenbacks than other options listed in a higher place. On average, selling a life insurance policy tin pay seniors 4 to eleven times more than what they'd get from surrendering information technology to the insurer. Due to this, life settlements are considered to requite you the best ROI. Moreover, life settlements are an first-class choice for people who no longer demand a death do good for supporting their families.

To be eligible for a life settlement, y'all must accept a whole, variable, universal, or convertible term policy and in almost cases must exist at least 70 years quondam.

Should You lot Cash Out Your Life Insurance?

While the real purpose of life insurance is to provide death benefits to back up your loved ones, that doesn't mean that y'all cannot reap the benefits of your policy while you lot're live. The options mentioned above can let you to cash in your life insurance policy if you lot need cash urgently. Cashing out your life insurance policy is a great fashion to admission money when you need it, but the pick you should employ depends on how much money you lot need and whether y'all want to maintain coverage.

If you only need a small-scale sum, withdraw money or have a pocket-sized loan from your policy. If you demand a much larger amount, see if you are eligible for living benefits or consider selling your policy through a life settlement.

Contact u.s. or call u.s.a. today at (800) 694-0006 to get in affect with our team to talk over your options for cashing out your life insurance policy and find out how much y'all can get for your life insurance policy.

Source: https://www.harborlifesettlements.com/can-i-cash-out-a-life-insurance-policy-heres-everything-you-need-to-know/

Posted by: hollowaycontaked.blogspot.com

0 Response to "When Can You Take Money Out Of Whole Life Insurance"

Post a Comment